Stock name: Garden Reach Shipbuilders & Engineers Ltd.

Pattern: Flag and pole pattern

Time frame: Daily

Observation:

The stock saw a sharp upward movement in late June 2024. In July, it is consolidating and correcting with range-bound movement, forming a flag and pole pattern on its daily chart. The stock has not yet broken out from this pattern. This consolidation has lowered the RSI from the overbought zone to a favourable level. According to technical analysis, if the stock breaks out upward from this pattern, it may continue to rise.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

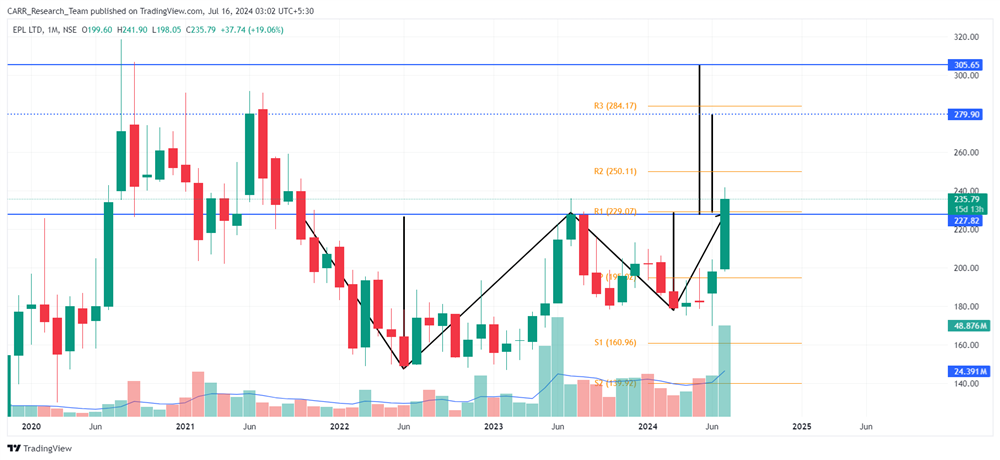

Stock name: India Cements Ltd.

Pattern: Rounding bottom pattern

Time frame: Monthly

Observation:

Since December 2007, the stock experienced a decline but recovered post-COVID, forming a rounding bottom pattern on its monthly chart. It is now trading above the December 2007 levels and the breakout line. However, the July month's candle has not yet closed to confirm the breakout. The stock recently showed a bullish MACD indicator, and its RSI level is high. Technical analysis suggests that if the breakout is confirmed, the stock may continue to rise.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

News for the day:

- JSW Infrastructure, India's second-largest port operator, plans to build green hydrogen and ammonia plants at its ports, including Vizhinjam, Kandla, Paradip, and Tuticorin. The company aims for 10-12% growth, new acquisitions, and developments at Jaigarh port and an LPG terminal by 2025. JSW Energy is focusing on the green sector to enhance connectivity and customer loyalty. Joint managing director Arun Maheshwari confirmed they are exploring opportunities in the emerging green hydrogen market.

- Suzuki predicts India's car market will grow fivefold to 20 million units by 2047, driven by electric vehicles (EVs). Aiming for a 50% market share by 2030, Suzuki plans to introduce its first EV in India and Europe next year. The company is developing new battery technology for everyday use models and sees potential in compressed natural gas cars. Collaboration with Toyota is expected to enhance product development. Suzuki's focus on India’s expanding middle class and environmental needs supports its long-term growth strategy.

- HDFC Bank's MD, Sashidhar Jagdishan, expressed disappointment over deposit growth for the June quarter, citing unexpected current account outflows. Although deposits grew 24.4% YoY to Rs 23.79 lakh crore, gross advances surged 52.6%, raising regulatory concerns about the credit-deposit imbalance. The bank plans to slow down advance growth and reduce the credit-deposit ratio to address these issues.