As we celebrate the auspicious arrival of Lord Ganesh, the god of new beginnings, a new company has made a noteworthy debut on the stock markets—Premier Energies Ltd, a name making headlines today. The company, with 29 years of experience in the solar industry, is primarily known as an integrated solar cell and solar module manufacturer.

Business Overview:

Premier Energies Ltd operates in various segments within the solar industry:

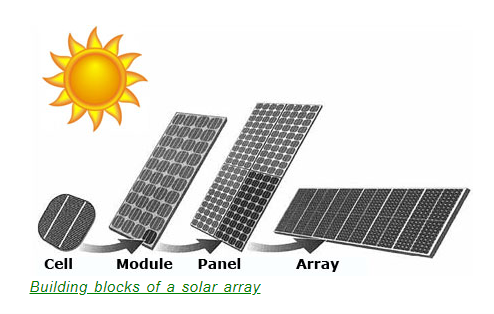

- Manufacturing of Solar Photovoltaic (PV) Cells: These cells are the building blocks for solar modules, converting sunlight into electricity.

- Manufacturing of Solar Modules: The company manufactures complete solar modules, which can be used in various applications.

- Customized Solar Products: Premier Energies offers bespoke solar solutions tailored to customer needs, such as customized solar tiles.

- EPC Projects Execution: The company undertakes Engineering, Procurement, and Construction (EPC) projects, providing end-to-end solutions in the solar sector.

- Operation & Maintenance Services: They offer maintenance services for EPC projects, ensuring the optimal performance of solar installations.

- Independent Power Production: Premier Energies also operates as an independent power producer, generating electricity from its solar assets.

Listing Performance:

Premier Energies Ltd’s IPO was priced at ₹450 per share, raising ₹2,830.40 crores, including a fresh issue of ₹1,291.40 crores. The IPO was heavily oversubscribed by 75 times, reflecting strong investor interest. The stock made a stellar debut, listing at ₹990 per share, a significant 120% premium over the issue price. It has since soared to ₹1,159.70, showcasing a remarkable performance within just four days of listing and creating a buzz in the market.

Post-Listing Scenario:

The company’s impressive market performance reflects the positive sentiment surrounding the solar industry, driven by increasing electricity consumption, a shift towards renewable energy sources, and supportive government policies. The solar sector, in particular, appears promising as the world transitions away from non-renewable energy.

What’s Next?

However, despite the current euphoria, the stock is trading at a high Price-to-Earnings (P/E) multiple of 225, suggesting that it may be overvalued at present levels. A rational approach for investors would be to add the stock to their watchlists and wait for market excitement to subside, allowing for a more reasonable entry point. As the broader industry dynamics remain favorable, Premier Energies Ltd is undoubtedly a stock to watch closely for potential opportunities in the future.