In living life, everything that the person is worried about losing tries to ensure that by something. Insurance companies are the one who provides such risk management to individuals, businesses, and institutional clients. This is done through various types of insurance products that customers look for i.e. life insurance, health or medical insurance, car insurance, etc. The basic principle of all such products remains the same that the insurer guarantees payment or reimbursement in the event of losses for the insured. From an investor’s perspective, investing in certain kinds of insurance companies like life insurance may appear risky as these businesses consist of long-term products and services, and also require high initial acquisition cost.

Therefore, while analyzing such companies’ certain business growth parameters need to be considered over the years and margins. We have covered in this blog such 3 parameters for the top 3 life insurance companies in India to take you through their short analysis to understand and compare these companies with each other. We have selected these top 3 companies based on the market capitalization as of 26th November 2020.

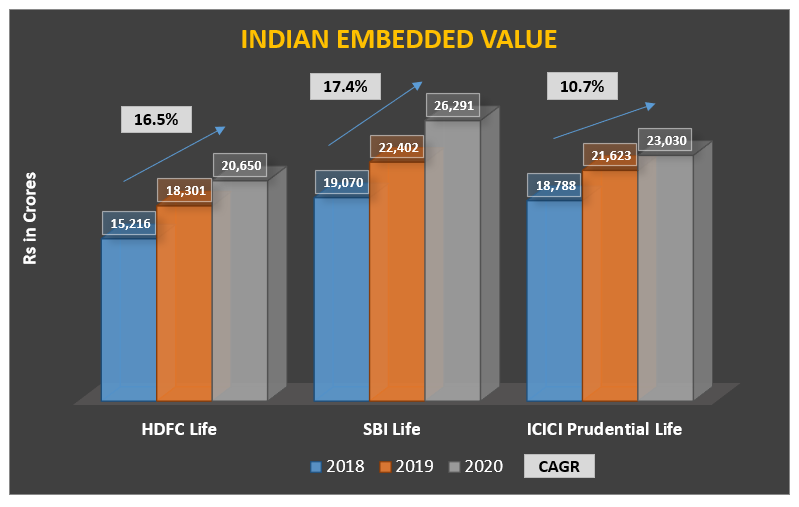

Embeded Value [EV]

This is the measure of the value of the life insurance company. This measure indicates the expected profitability from the current underwritten policies and current net worth. The embedded value of the company is calculated as the sum of adjusted net worth and the discounted value of profits from in-force policies.

Below is the comparison of the embedded value of the top 3 insurance companies:

New Business Premiums [NBP]

As the name indicates, this is the value of premium acquired by the entity from new policies for a particular year. So, the premium earned from the new contracts in a given financial year is referred to as the new business premium for an insurance company. Very natural to understand, if the company is able to grow at a higher rate with NBP, the business perspectives seem to be on the high good side.

Below is the comparison of NBP for the top 3 life insurance companies:

- New Business Margin [NBM]

This is a measure of profit margin used by the insurance companies for the new business received during a particular financial year. NBM is the ratio of the value of the new business to the present value of premium income. It is calculated by dividing the profit on the new business by the present value of the new business or Embedded value.

Conclusion:

Based on the above analysis, one can compare these parameters for the top 3 life insurance companies and understand the fundamental analysis of such companies. Rather, these are not the only parameters to be considered for investment decision making, so consideration of other factors along with these is important.