Stock name: Cyient Ltd.

Pattern: Double bottom pattern and retest

Time frame: Daily

Observation:

The stock has been declining since December 2023 but formed a double bottom pattern from April to August 2024 on its daily chart. It broke out of this pattern on August 20, 2024, with strong trading volume, leading to some upward movement. Currently, the stock is undergoing a low-volume retest, which has cooled the RSI from overbought levels. According to technical analysis, if the stock rebounds from this retest with good momentum, it may continue to rise further.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

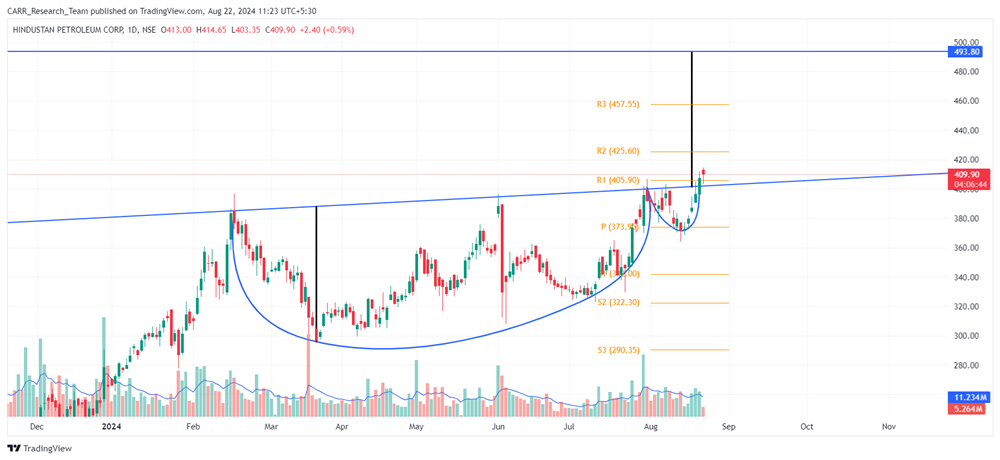

Stock name: Archean Chemical Industries Ltd.

Pattern: Cup and handle pattern and retest

Time frame: Daily

Observation:

Since its listing in November 2022, the stock has been on an upward trend. Recently, from February to August 2024, it formed a cup and handle pattern on its daily chart, breaking out on August 22, 2024, with strong trading volume. However, the stock is now undergoing a retest of this breakout, requiring further confirmation of momentum. The RSI is currently in a favourable zone, and according to technical analysis, if the stock capitalizes on the breakout and gains momentum, it may continue to move higher.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

News for the day:

- The Adani Group, led by Gautam Adani, sold a 2.8% stake in Ambuja Cements for Rs 4,200 crore, leading to a 4% rise in the stock price. Following this sale, the group's stake in the company now stands at 70.33%. This comes after Ambuja Cements recently acquired Penna Cement for Rs 10,422 crore, enhancing its market share in southern India. The sale was conducted via a pre-market block deal, with Holderind Investments, an Adani Group entity, offering shares at a slight discount to the previous closing price.

- HDFC Bank has rejected a $2 billion proposal from Japan's MUFG to purchase a 20% stake in its non-banking subsidiary, HDB Financial Services. Instead, the bank's board has opted to pursue a listing of HDB to meet RBI regulations. This decision halts what would have been the largest FDI deal in India's financial services sector, disappointing Japanese officials who had strongly supported the transaction.

- Dabur India Limited has signed a Memorandum of Understanding (MoU) with the Tamil Nadu government to establish its first manufacturing unit in South India. The initial phase of the project involves an investment of Rs 135 crore, with plans to scale up to Rs 400 crore over five years. The facility aims to meet the rising demand in South India, create approximately 250 direct jobs, and boost economic development in the region. This strategic move will also enhance Dabur's sourcing of agricultural produce from local farmers in Tamil Nadu.